Health is important to live life to the fullest. Having good health is of core importance to human happiness.

Adamjee Life with a believe that living a healthy life would extend longevity, introduces Adamjee Life Sehat Kafalat that offers the option of daily cash benefit on Hospital Confinement due to sickness and accident.

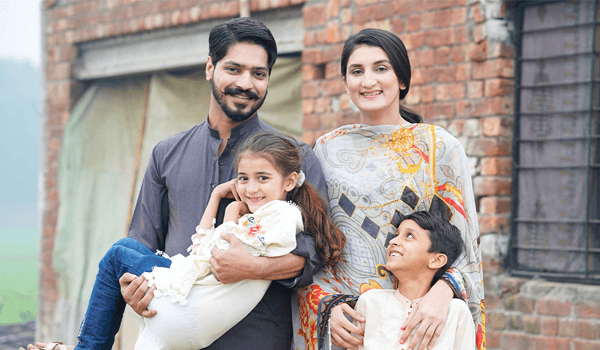

One can opt Adamjee Life Sehat Kafalat for his/herself, spouse and children(up to the age of 25 years) and enjoy Hospitalization Cash Benefit during the policy term.

Benefit Limits and Annual Premium per Insured Person:

By paying annual premium of just Rs.500/- insured will get the hospitalization benefit of Rs 2,000/- per day, up to a maximum of 30 days during a policy year.

Per confinement benefit is limited to a maximum of 15 days of hospitalization. Successive periods of hospital confinement, due to same or related causes, not separated by more than thirty (30) days shall, for the purpose of evaluating a claim, be considered to constitute one continuous period of hospital confinement.

Eligibility:

Individual within the age bracket of 18-59 years can opt Adamjee Life Sehat Kafalat. It provides coverage up to maximum age of 60 years. The eligibility for children to get insured is minimum 3 months and maximum 24 years and coverage can go up to maximum of age 25 years.

15 days waiting period from policy commencement date shall be applicable for sickness related hospitalization.